How to Handle UK Subsidy Payments in Xero

Scenarios:

You utilise Enrolmy's UK Subsidy Reconciliation Process and are integrated with Xero

You want to know how to reconcile UK Subsidy Payments to their relevant Suspense Accounts

This document assumes the following:

You understand how to utilise Enrolmy’s UK Subsidy Reconciliation Process

You understand basic accounting principles

You have set up the relevant Xero UK Subsidy Account Codes:

How To Reconcile UK Subsidy Payments Inside Xero

Remember, UK Subisdy Payments have already been reconciled against customer invoices inside Enrolmy as a Subsidy Credit Note. Therefore, you do not need to match the UK Subisdy Payment against the customer's invoice inside Xero.

Rather, you should code the payment to the relevant UK Subsidy Account Code:

For example:

Tax-Free Childcare Subsidy Payments reconciled to Xero account code 853 - Tax-Free Childcare Balance

Within the bank reconciliations section within Xero, against your received WINZ Payment, you should use the following reconciliation references:

WHO: Tax-Free Childcare

WHAT: Tax-Free Childcare Balance

WHY: (Insert Statement Week Date)

See here how to create a rule for each transaction so that it can help you reconcile payments more easily within Xero: https://central.xero.com/s/article/Create-a-bank-rule#Createabankrule

How To Find Your UK Subsidy Reports

Log into your Xero account and select Accounting

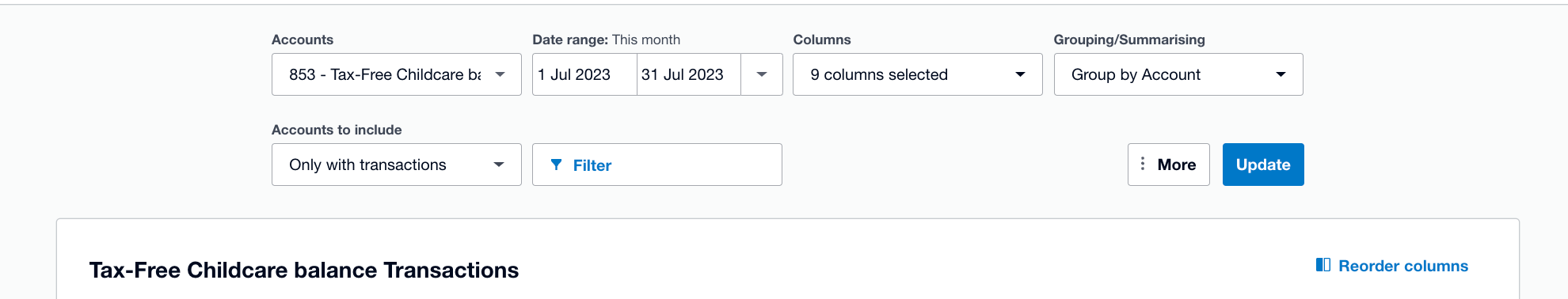

Next, select Account Transactions and search for the relevant UK subsidy account code i.e. 853 - Tax-Free Childcare Balance

Select the date range of the month you want to see and click update

Awesome! You can no go ahead and reconcile your UK subsidy Payments in Xero.

Last Updated: