Credit/Debit Card Transactions Explained

Scenarios:

You are taking credit/debit card payments

You want to know how to view and manage your Credit/debit Card payments through Enrolmy

This document assumes the following:

You know how to navigate around the Credit Card section of Enrolmy

You understand how the basic transaction fees are calculated

Where To Find Credit Card Transactions

Click on the Money tab in the top navigation bar and select Credit card transactions

Here you can view the following:

All the payments made to you by credit card

The date of each transaction

Credit/Debit Card Transactions Overview

All examples below are utilising the split fee option:

Customer pays 1.85%

Provider pays 1.85% + 30c

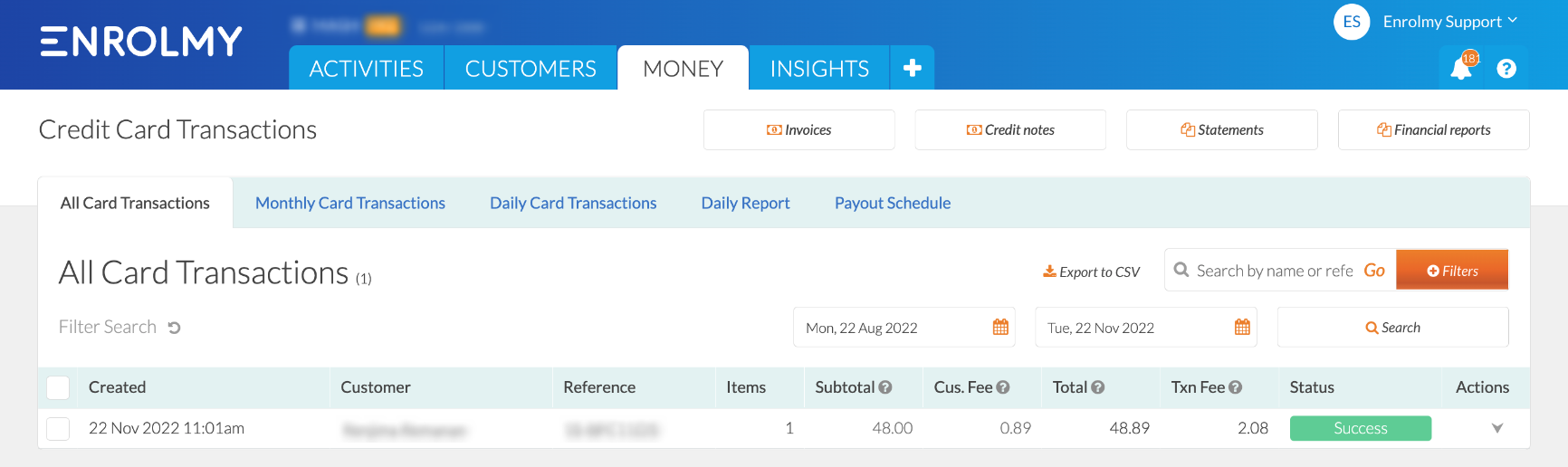

All Card Transactions

Here, you will see the accumulative transactions for all time.

Column | Description | Example |

|---|---|---|

Items | Total number of invoices paid | 1 invoice |

Subtotal | Total value of invoices paid | Total amount of invoice is $48.00 |

Cus.Fee | Credit card fee paid by customer | 1.85% (CREDIT/DEBIT CARD FEES) of $48.00 (INVOICE TOTAL) = $0.89 |

Total | Total amount paid by customer | $48.00 (INVOICE TOTAL) + $0.89 (CREDIT/DEBIT CARD FEES) = $48.89 |

Txn Fee | Total fee for this transaction | $0.89 (CUSTOMER FEES) + $0.89 +30c (PROVIDER FEES + TRANSACTION FEE) = $2.08 |

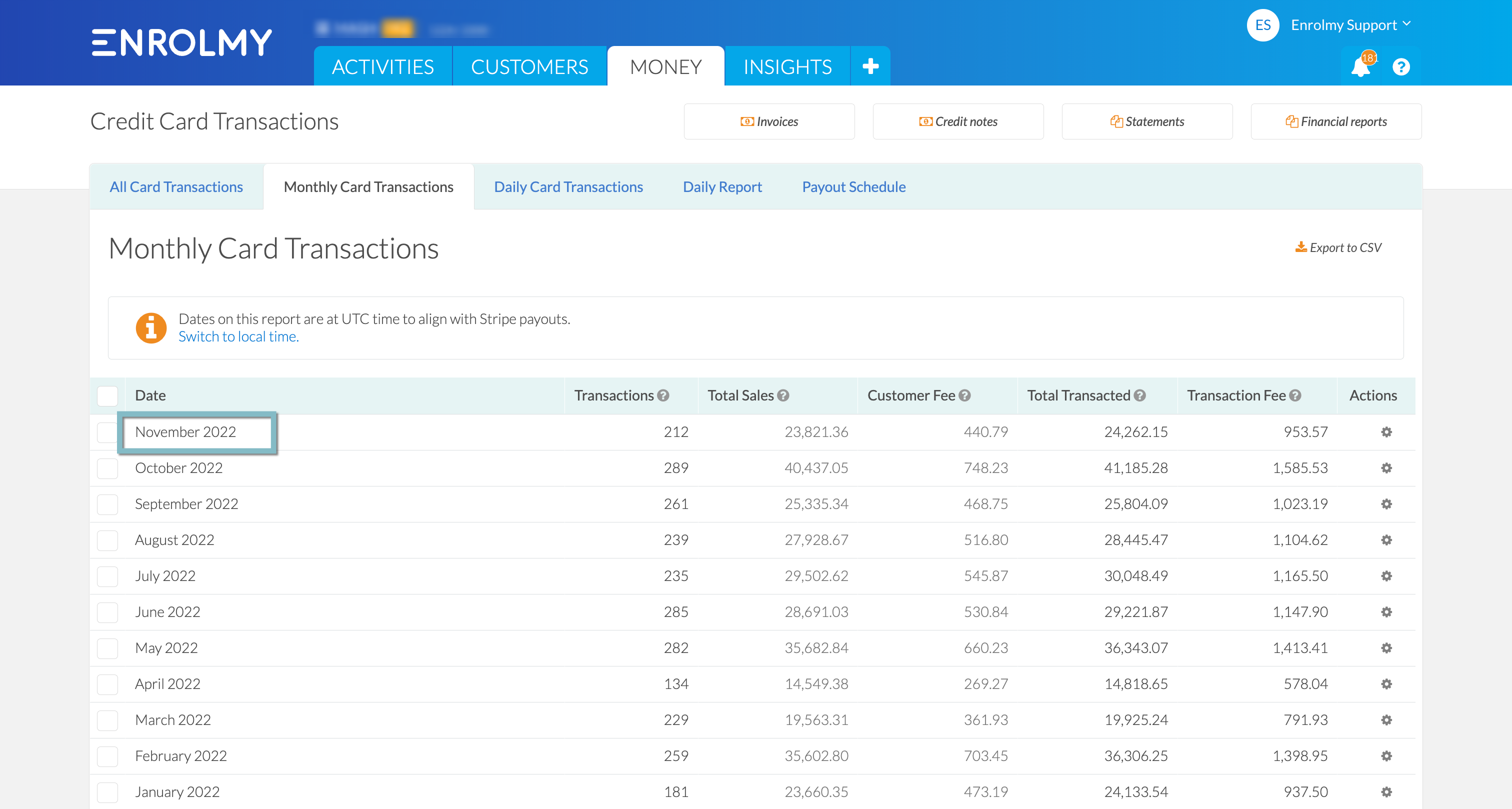

Monthly/Daily Card Transactions

Here, you will see the accumulative transactions for each month/day.

Column | Description | Example |

|---|---|---|

Transactions | Total transactions per month | For NOVEMBER there was a total of 212 transactions that took place |

Total Sales | Total value of sales per month | Total amount of sales for NOVEMBER is $23, 821.36 |

Customer Fee | Total credit card fees paid by customer per month | 1.85% (CREDIT/DEBIT CARD FEES) of $23, 821.36 (TOTAL SALES) = $440.79 |

Total Transacted | Total amount paid by customers per month | $23, 821.36 (TOTAL SALES) + $440.79 (CUSTOMER FEES) = $24, 262.15 |

Transaction Fee | Total fees for monthly transactions | $440.79(CUSTOMER FEES) + $512.78(PROVIDER FEES + TRANSACTION FEE 30C) = $953.57 |

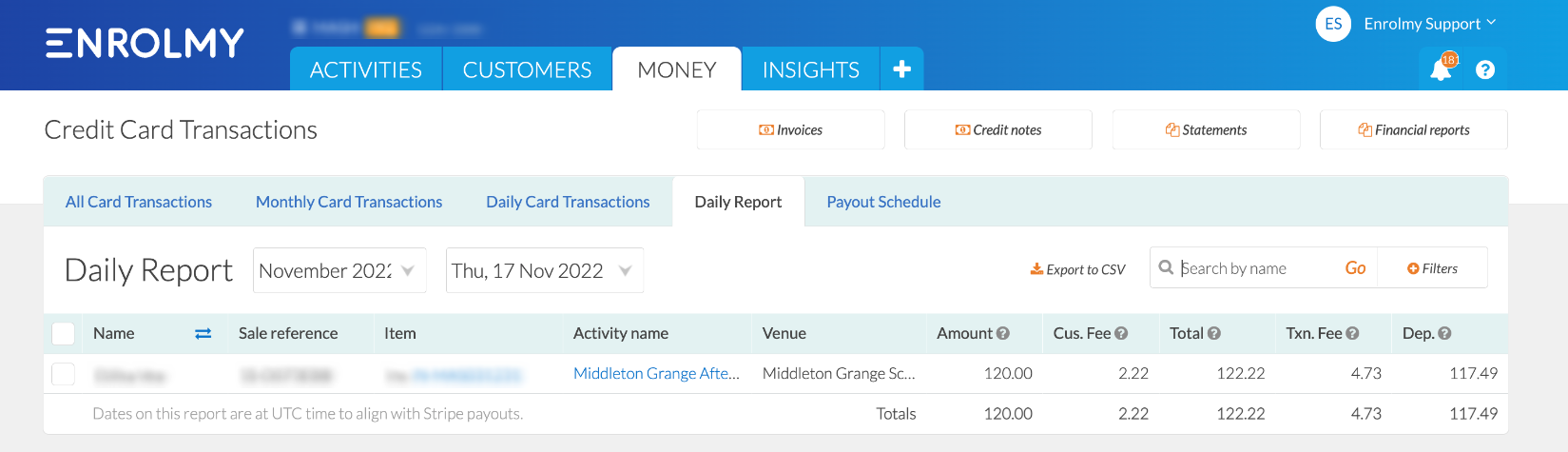

Daily Report

Here, you will see the accumulative transactions for each day within a specific month.

Column | Description | Example |

|---|---|---|

Sales Reference | Credit card reference | Will always start with SS |

Item | Invoices that that have been paid | These are clickable for quick reference of the invoices |

Activity Name | Payment associated with an activity | These are clickable for quick reference of the invoices |

Venue | Payment associated with a venue | This is directly related to your activity |

Amount | Total transaction | Total amount = $120.00 |

Customer Fee | Total credit card fees paid by customer | 1.85% (CREDIT/DEBIT CARD FEES) of $120.00 (AMOUNT) = $2.22 |

Total | Total amount paid by customers | $120.00(AMOUNT) + $2.22 (CUSTOMER FEES) = $122.22 |

Transaction Fee | Total fees paid for this transaction | $2.22(CUSTOMER FEES) + $2.51(PROVIDER FEES + TRANSACTION FEE 30C) = $4.73 |

Deposit | Total deposited in your account for this transaction | $122.22 (TOTAL) - $4.73 (TRANSACTION FEE) = $117.49 |

Payout Schedule

Here, you will see the accumulative transactions for each day alongside the expected payout date.

Column | Description | Example |

|---|---|---|

Date | Date of transactions |

|

Transactions | Total number of transactions | 11 TRANSACTIONS in total |

Total Sales | Total value of all invoices paid by credit card on this day | TOTAL SALES = $855.25 |

Transaction Fees | Total of all transaction fees | 3.70% (CUSTOMER FEES + PROVIDER FEES) of $855.25 (TOTAL SALES) + $3.30 (30C PER TRANSACTION) = $34.92 |

Gross | Total of all credit card payments received on this day | $836.15 (AMOUNT DUE) + $34.92 (TRANSACTION FEES) = $871.07 |

Fee Expense | Transaction fee expense | $855.25 (TOTAL SALES) - $836.15 (AMOUNT DUE) = $19.10 |

Amount Due | Expected Deposit for all sales for this day | A total of $836.15 is the expected deposit |

Payout Scheduled | Payment amount that has been scheduled by Stripe | $2,243.07 has been scheduled to be paid out NOTE this is an accumulated amount from previous transactional days. Please see here for more information: https://helpcentre.enrolmy.com/entkb/credit-card-payout-schedule-explained |

Payout Due | Date of when payout will occur | $2,243.07 will appear in your bank account on |

Great! You now understand a bit more about the credit card section in Enrolmy!

Last updated: