Managed Revenue Recognition Report

Scenarios:

You want to see a report of all invoices and credit notes that took place during a set month and what your revenue is, based on that activity

You want to understand the difference between a dynamic and managed revenue report

This document assumes the following:

You have read and understood the Financial Reports help guide

You are one of the head administrators of your Enrolmy Account

You are proficient with accounting principles

You have run/are running activities on Enrolmy that are being invoiced

What Is A Managed Revenue Recognition Report

Based on that activity, you may want to see a report of all invoices and credit notes during a set month and your revenue. Unlike the dynamic report, this is a static report and will not change unless the report states it is provisional.

Managed Revenue Recognition Report Explained

It is possible to generate and save automated monthly financial reports in Enrolmy:

Payments received during the specified month period are NOT reflected in these report types.

Draft invoices and credit notes are NOT calculated in the reports

WINZ Credit Notes and Active/Creative Kids Voucher credit notes are excluded from this report calculation.

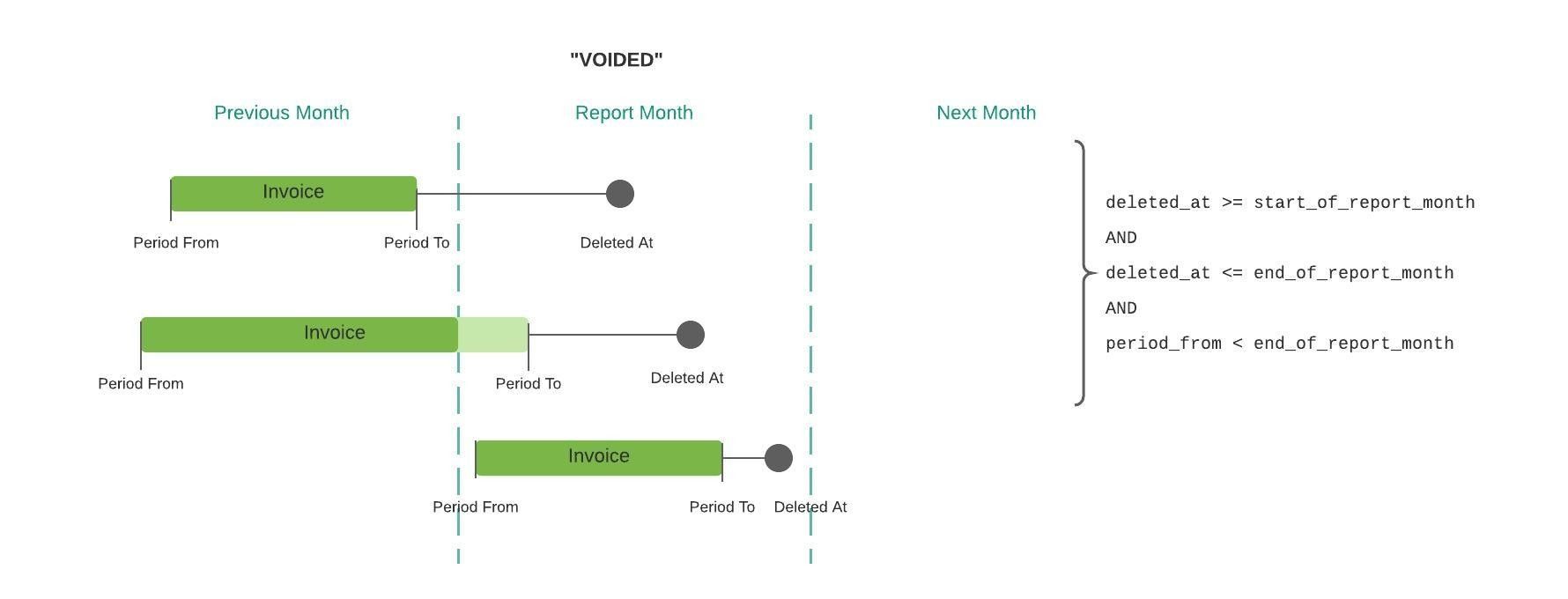

This report displays invoices, provisional invoices, credit notes, voided invoices, and voided credit notes that took place took place during the specified month.

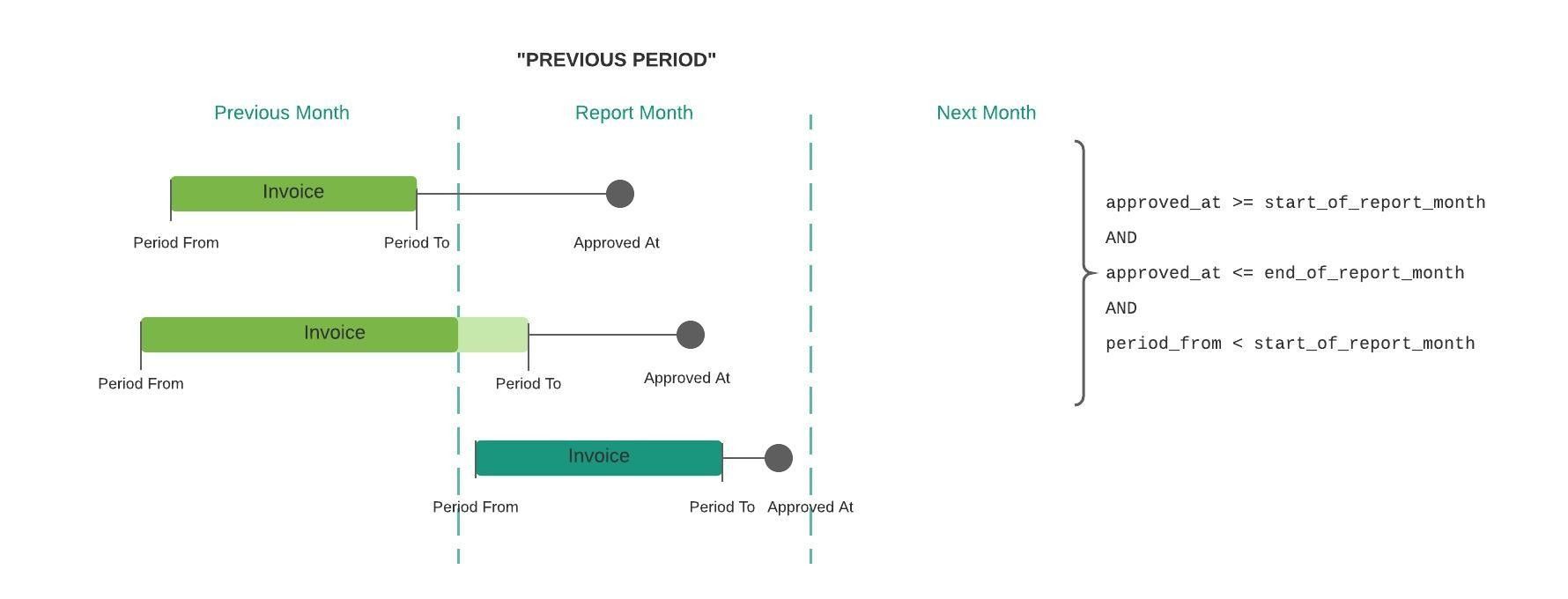

Invoices and credit notes for previous periods are for invoices/credit notes that are generated in the set month period, but the activity occurred in a previous period and was not highlighted on a previous report month.

What Are Provisional Invoices

Provisional invoices reflect prepayment requests sent. Provisional invoices are included in the Managed report to enable you to estimate future invoicing. If you are a provider who runs a before & after school care activity that takes prepayments and invoices weekly or fortnightly. We suggest you exclude the provisional invoices total from your report calculations. This is because Enrolmy will count your prepayment request and the invoice. This could essentially double up your invoices + provisional invoices calculations.

Overall Total Calculation

The overall total calculation = (Invoices + provisional Invoices + invoices for previous periods) - (Credit notes + credit notes for previous periods + voided invoices + voided credit notes)

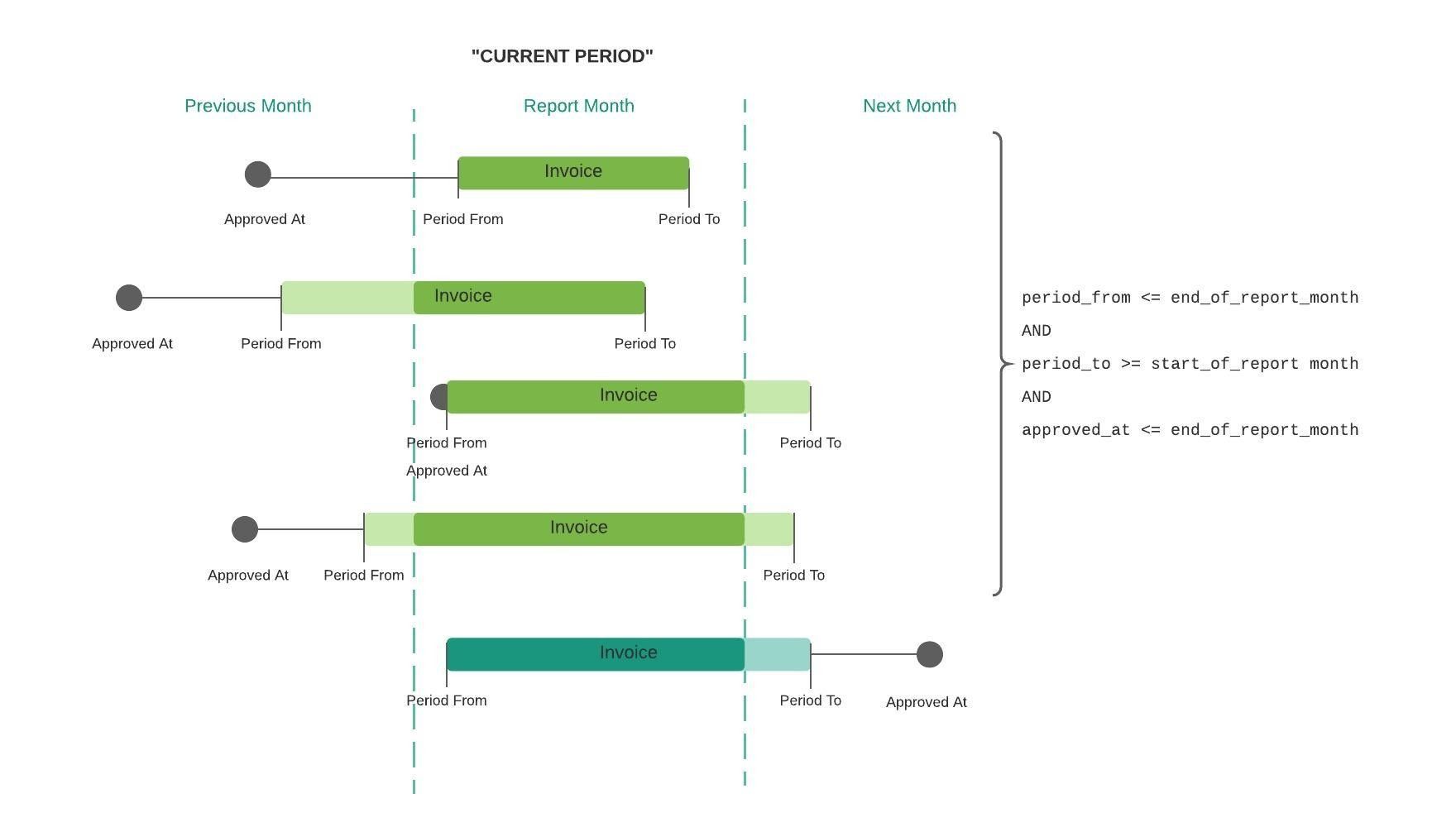

How invoices/credit notes for the current report period are included in the report:

Line Item Display

Invoices and credit notes are represented by their line items and credit note line items.

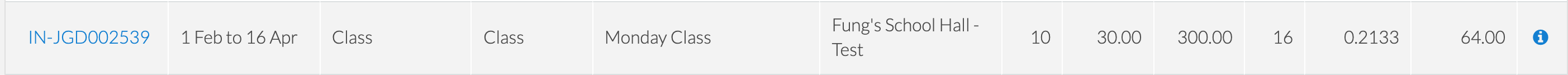

In the example below, you can see that INV-JG002539 is highlighted three times on the report. This is because there were three line items on the invoice itself. The report breaks down each line item.

Weighting Calculations

You may notice that the report has a weighting calculation column. Where the period of the invoice/ credit note extends across two or more months, a weighting calculation is made. The total value of the line item will be proportioned equally across all months covered by the period on the invoice/credit note.

For example, you can see that the invoicing period for IINV-JG002539 begins in February 2021 and ends in April 2021

The total value of the Monday Class line item = $170.00

3. However, the managed revenue report has calculated that $64.00 of the Monday Class line item is to be 'allocated' towards the report for this month. Instead of the total $300.00 worth of that line item.

Other things to know;

The weighting calculation is not based on the date the parent booked but rather on the activity is running.

The “weighting” calculation is the “number of days for invoice in report month divided by the total number of days for the invoice period”. This “weighting” value is then multiplied by the total value of the invoice for the “weighted total” value.

How invoices/credit notes for a previous report period are included in the report.

How invoices/credit notes for a previous report period are included in the report.

Awesome! Have a go at generating your own Managed Report now!

Last Updated: