Accrued Revenue Report

Scenarios:

You would like to understand how the Accrual report works

You would like to establish how much revenue you are making in a day

This document assumes the following:

You have read and understood the Financial Reports help guide

You are one of the head administrators of your Enrolmy Account

You are proficient with accounting principles

You have run/are running activities on Enrolmy that are being invoiced

Table of Contents

What Is An Accrued Revenue Report

The Accrued Revenue Report is a new interpretation of the existing “Managed Revenue Recognition Report” where revenue is attributed to the booking date. This report will now show exactly how much revenue is generated per day.

Accrued Revenue Report Explained

The report data is sourced from Approved Invoices and Credit Notes, so only bookings that have been invoiced will appear on the report. Invoices and credit notes for bookings will show as accruing revenue on each date of the attendee’s actual booking.

Other manually created invoices, non-booking invoices, will also appear on the report, but this revenue will accrue when the invoice is generated.

The entire report functions as a “snapshot in time, " meaning the data will remain static monthly. If an invoice has been generated late, for example, an invoice for an August booking is generated in September. The invoice will appear on the September report as an “Invoice for a previous report period”, and the August report will remain unchanged.

In this respect, the Accrued Revenue Report works the same way as the existing Managed Recognition Report:

If the line item is for a booked session (e.g. “Afternoon Session”) or a discount, the booking date is the accrual date.

If the line item is not for a booking, such as an Additional Item, but is included on an invoice, then this item will also align to accrue on the date of the bookings.

If the line item is on an invoice not created by Enrolmy’s invoice generator, in other words, manually raised, then revenue will accrue in full on the invoice date.

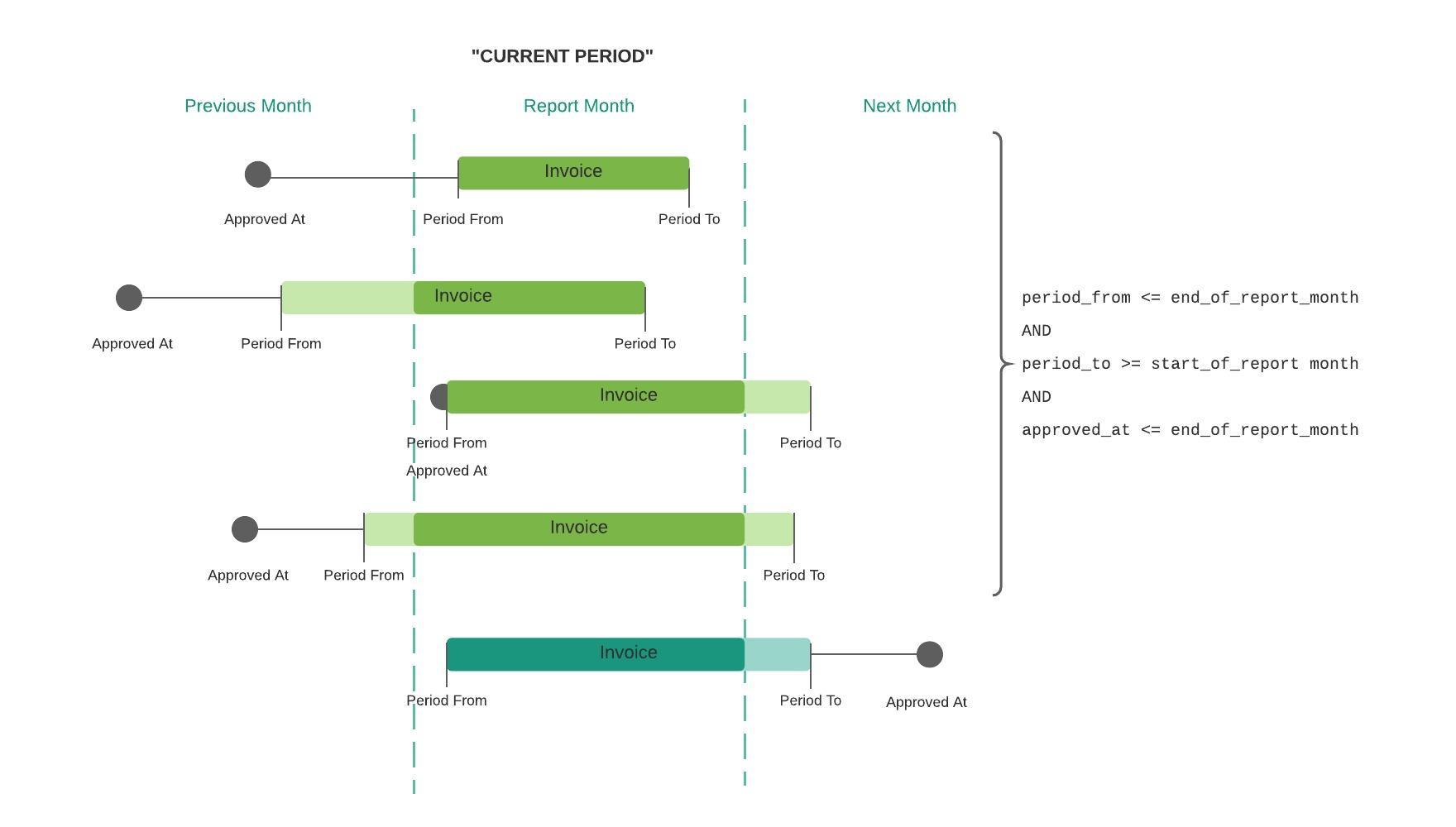

How Invoices and Credit Notes “for the current report period” are included in the report:

How Invoices and Credit Notes “for a previous report period” are included in the report:

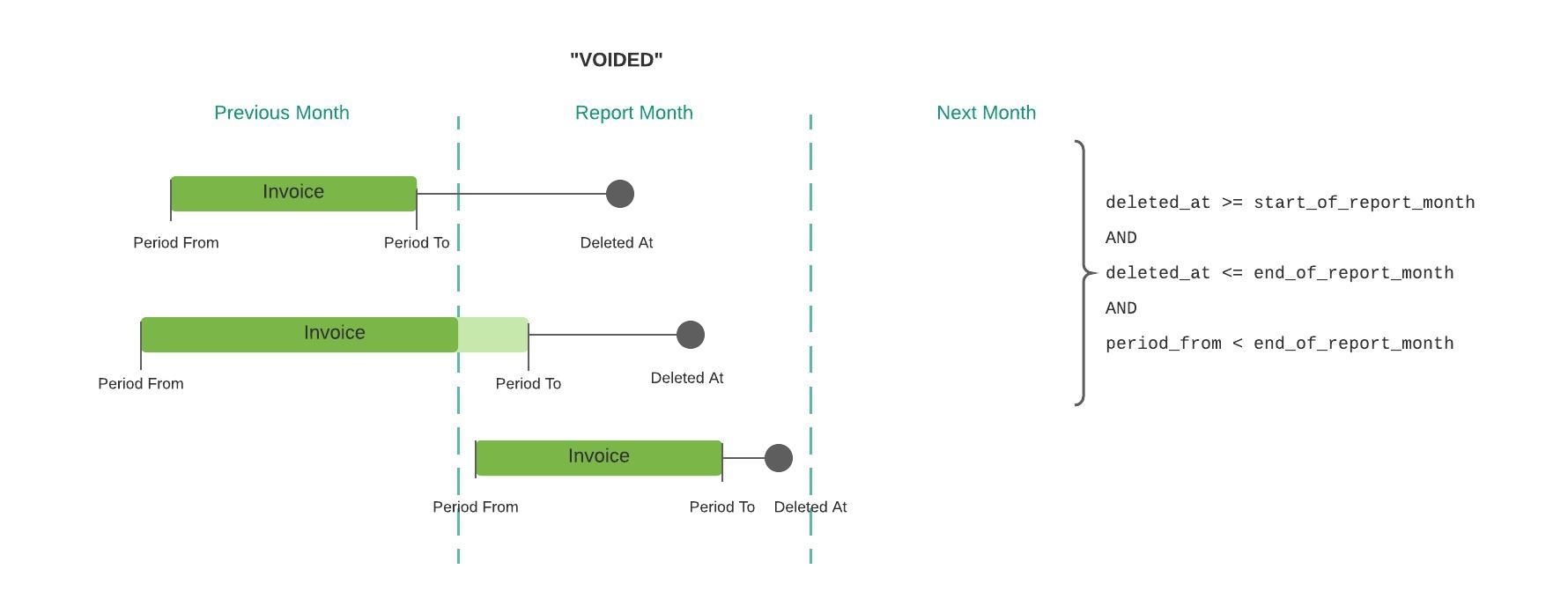

How Voided invoices and credit notes are included in the report:

Accrued Revenue Report Graph

A revenue per day graph is generated alongside the report itself. This creates a quick visual snapshot of the revenue captured per day:

Accrued Revenue Report Example

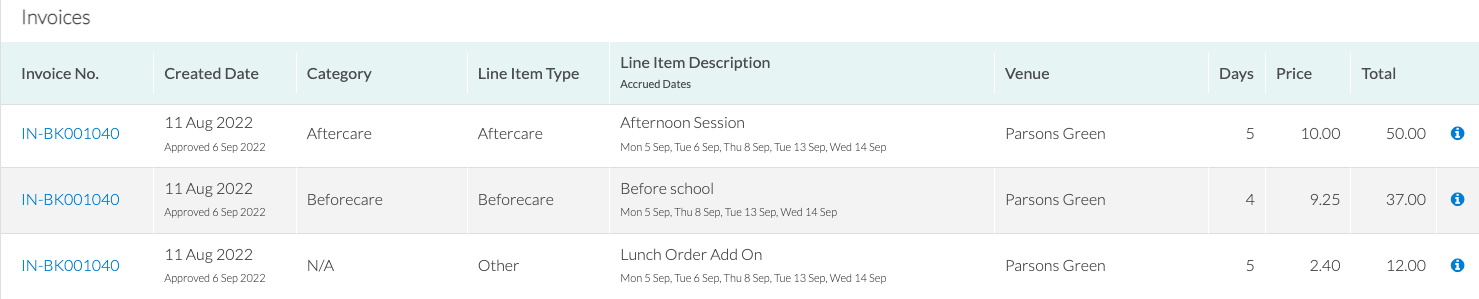

This is how a single invoice appears on the September report:

In this example, an invoice was created for two weeks of a child’s Before care and Aftercare booking at Parsons Green in August and September.

Even though the invoice in this example was generated for a booking that spans August and September, only revenue accrued in September is shown on the report.

Each line item from the invoice is shown as an item on the report. The dates of the child’s booking are shown beneath the Line Item Description (ie Session name). These are also the dates that the revenue accrues. The total shows only the value of the September booking and not the total as shown on the invoice line item.

Accrued Revenue Use Cases

Below are some examples of how the Accrued Revenue Report can be utilised:

Determining revenue accumulation per day/per session

Determining the value of discount usage

Predicting potential revenue income for future months

Observing and managing trends/ patterns in revenue periods

The accrual report can be used to compare/audit revenue between two different systems, such as Xero and Enrolmy, to ensure like for like

Awesome! You now understand the accrual report on Enrolmy!

Last Updated: